Introduction: Why Personal Finance & Crypto Investing Belong Together

Not too long ago, the world of personal finance was simple: budgeting, saving, investing in stocks, maybe buying a home. But today, a new dimension has entered the money conversation—crypto investing.

The personal finance & crypto investing connection isn’t just a buzzword. It’s about understanding how to balance traditional money management with the opportunities (and risks) of digital assets like Bitcoin, Ethereum, and stablecoins.

If you’re like me, you’ve probably faced this dilemma: Should I put my savings into safer investments like index funds, or take a risk on crypto? The answer isn’t black and white. It’s about building a strategy where the old and new worlds of money can coexist.

Let’s break it down.

Understanding the Foundations of Personal Finance

Before diving into crypto, it’s important to master the basics of personal finance. Think of it as building a strong foundation before adding a new floor to your financial house.

Key pillars include:

- Budgeting: Following rules like the 50/30/20 rule (50% needs, 30% wants, 20% savings/investments).

- Emergency Fund: At least 3–6 months of living expenses in cash or a high-yield savings account.

- Debt Management: Paying off high-interest debt before chasing high-risk returns.

- Long-Term Planning: Retirement funds, insurance, and steady investments like index funds.

Without these, crypto investing becomes gambling rather than wealth building.

Where Crypto Fits Into Personal Finance

So, how does crypto actually fit into personal finance? Think of it as the “growth engine” of your portfolio.

Here’s a simple analogy:

- Cash & Savings = Your foundation (safety net).

- Stocks & Bonds = Your core investments (steady growth).

- Crypto = Your high-risk, high-reward accelerator.

Crypto investing can be powerful, but it should only be a slice of the pie—most experts suggest 5–15% of your portfolio.

Personal Story: How I Blended Crypto Into My Finances

Back in 2020, I made my first crypto purchase—$500 in Ethereum. It wasn’t a lot, but I treated it as an “experiment” rather than a retirement plan. That $500 grew into over $2,000 during the 2021 bull run.

The key? I didn’t panic sell when it dipped, and I didn’t throw in my life savings either. I balanced it with index funds and an emergency fund. This approach gave me the confidence to expand into other areas like stablecoin savings (earning 4–6% yields on platforms like Coinbase or Binance).

Crypto wasn’t a replacement for my personal finance strategy—it was an enhancement.

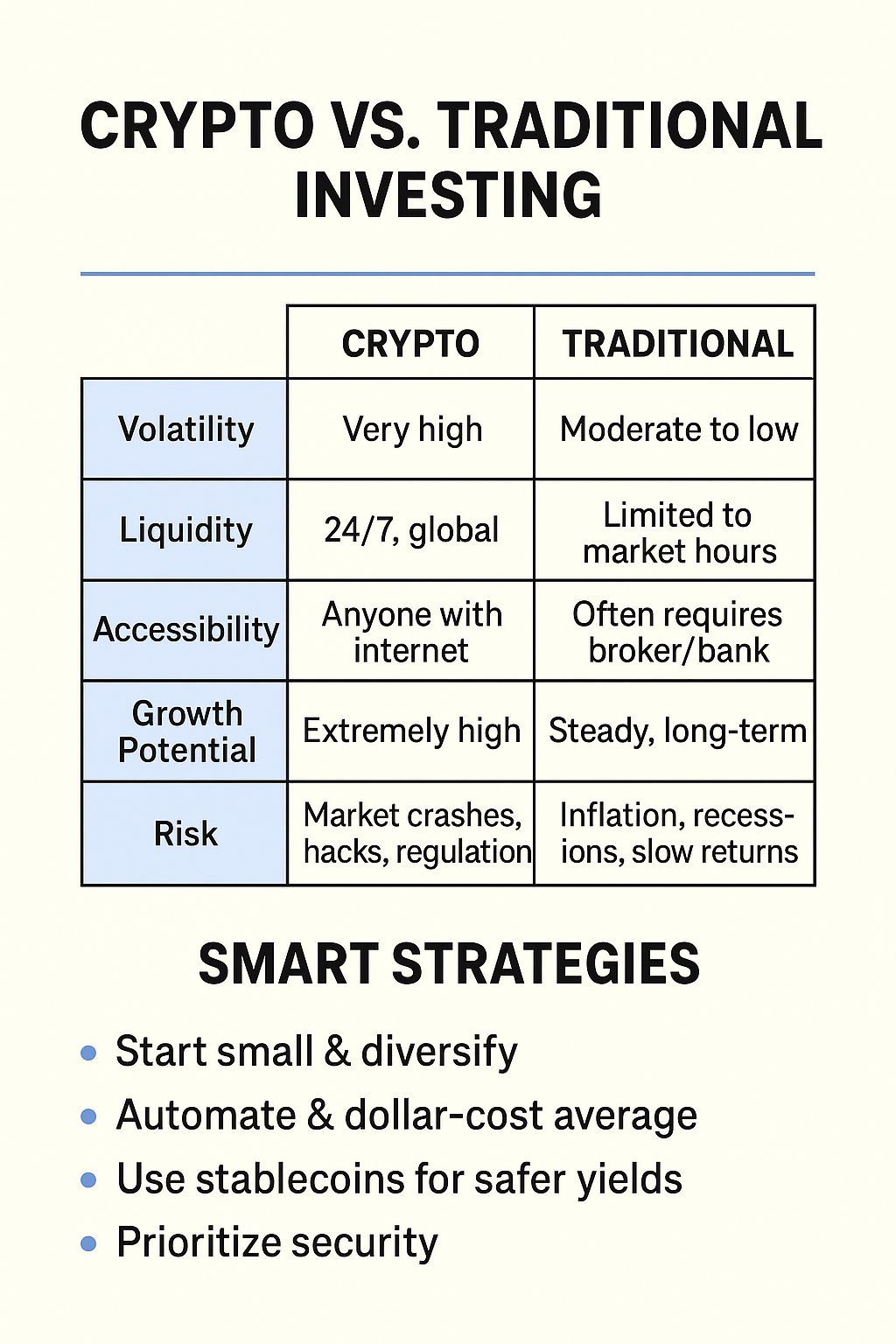

Crypto Investing vs. Traditional Investing

📊 Comparison Table: Crypto vs. Traditional Assets

The takeaway? Crypto offers growth and flexibility, but traditional finance provides stability. The sweet spot lies in combining both.

Smart Strategies for Personal Finance & Crypto Investing

Here’s how to integrate crypto into your financial plan without losing sleep:

1. Start Small & Diversify

- Begin with 5% of your total investments in crypto.

- Diversify: Bitcoin (store of value), Ethereum (tech backbone), Stablecoins (yield).

2. Automate & Dollar-Cost Average (DCA)

Instead of chasing pumps, invest a fixed amount monthly. DCA smooths out volatility and reduces emotional decision-making.

3. Use Stablecoins for Safer Yields

Platforms like Circle’s USDC or Tether (USDT) offer interest-bearing accounts. This is great for conservative investors who want exposure without massive risk.

4. Prioritize Security

- Use hardware wallets (Ledger, Trezor).

- Enable 2FA.

- Only keep what you need on exchanges.

5. Stay Educated

Crypto moves fast. Subscribe to reliable sources like CoinDesk, Messari, or even central bank reports on digital assets.

Risks You Should Never Ignore

While crypto offers massive upside, ignoring the risks is a recipe for disaster:

- Volatility: 50% drops aren’t unusual.

- Scams & Hacks: From rug pulls to exchange hacks.

- Regulation: Governments may impose sudden restrictions.

- Emotional Investing: Fear and greed can lead to poor decisions.

The golden rule: Never invest money you can’t afford to lose.

Explore Our Related Posts

Stable Coins Banking Revolution 2025

How To Build Passive Income In 2025

FAQs: Personal Finance & Crypto Investing

1. How much of my portfolio should I put into crypto?

Most experts recommend 5–15%, depending on your risk tolerance and financial stability.

2. Are stablecoins safe for savings?

They’re safer than volatile crypto, but risks still exist (issuer transparency, platform security). Stick with well-regulated ones like USDC.

3. Can crypto replace traditional investments?

No. Crypto should complement, not replace, core assets like stocks, bonds, and real estate.

4. What’s the best way to start with crypto investing?

Start small, use dollar-cost averaging, and focus on top projects like Bitcoin and Ethereum.

5. Should I pay off debt before investing in crypto?

Yes—always pay high-interest debt first. Crypto should never come before financial stability.

Conclusion: The Balanced Future of Money

The future of personal finance & crypto investing isn’t about choosing one over the other—it’s about integration. By mastering the basics of personal finance and layering crypto on top, you create a portfolio that’s both stable and future-proof.

Personally, crypto gave me not just higher returns but also a new perspective on money. It made me value decentralization, borderless payments, and financial independence. But I also learned the importance of balance—without budgeting, savings, and traditional investing, crypto would’ve just been a gamble.

As we move forward, the winners will be those who adapt, not those who cling to old systems or blindly chase new ones.

🚀 Call-to-Action

Would you blend crypto into your personal finance strategy—or keep them separate?

👉 Share your thoughts in the comments, subscribe to our newsletter, and check out our guide on future of cryptocurrency for deeper insights.